Business accounting

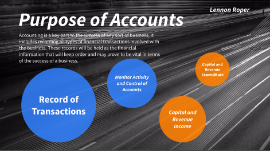

Transcript: BUSINESS ACCOUNTING Aisha Ali It is a systematic process of identifying, recording, measuring, classifying, verifying, summarizing, interpreting and communicating financial information. It reveals profit or loss for a given period, and the value and nature of a firm's assets, liabilities and owner's equity. what is accounting someone whose job is to provide financial reports about a company’s profits, debts, cash flow etc. so that investors, banks, etc. can measure the company’s performance: Financial accountants draw up the profit and loss account, balance sheet and cash flow, statement for the company as a whole. who is a financial accountant what is his role in am organization Review financial records and transactions . Report to senior management Advise management Tax issues Role of finacial accountant in an organisation my business The business i decided to do on is a corner shop (kiosk) record transactions A business must record all of the money that is coming into the business(from sales) and all the money going out, such as expenses. if my corner shop business fails to do this they might fail in trouble with KRA since they wont have record the transactions correctly their tax payment pay be wrong. The five purposes of accounting Monitoring activity records will be updated on a regular basis and therefore provide a good indication of how my corner shop business is doing in terms of sales, receiving payments and paying expenses, by doing so i would get to see if money going out seemed to be on the increase while sales were dropping off. Control if accurate records of transactions are maintained and activity closely monitored, then actions can be taken to control the balance between money flowing in and out of the business. for example in my business the corner shop, if the appeared that expenses were creeping up but sales staying the same, then i will have to look for ways to control or cut costs management of the business a manager is someone who is responsible for planning, controlling and monitoring of resources. management of a business involves careful co ordination of resources including staff, materials, stocks and money. the manger must ensure there are sufficient funds to pay wages, order new stock and pay bills to meet other demands for cash outflows balancing with the money coming in from sales Measurement of financial performance without financial records it would be impossible to know of the business is making profit and loss or whether the business owned debts. Businesses accounting looks at money coming into and out of a business. key features of financial performance include: gross profit net profit value owed to the business value owed by the business External competitors - Entities competing against a business will attempt to gain access to its financial statements, in order to evaluate its financial condition. The knowledge they gain could alter their competitive strategies. Government - A government will request financial statements in order to determine whether the business paid the appropriate amount of taxes. Investors - Investors will likely require financial statements to be provided, since they are the owners of the business, and want to understand the performance of their investment. Suppliers - Suppliers will require financial statements in order to decide whether it is safe to extend to the business. Unions - A union needs the financial statements in order to evaluate the ability of a business to pay compensation and benefits to the union members that it represents. key users of financial information Internal customers - When a customer is considering which supplier to select for a major contract, it wants to review their financial statements first, in order to judge the financial ability of a supplier to remain in business long enough to provide the goods or services stated in the contract. owners - owners will want to see the finacial statement so they can plan for the future and also see how well the business is doing. using a business your familiar with describe their accounting history and compare this to their current financial performance & position Revenue - The income generated from sale of goods or services, or any other use of capital or assets, associated with the main operations of a business before any costs or expenses are deducted. Expenditure - Payment of cash or cash-equivalent for goods or services, or a charge against available funds in settlement of an obligation as evidenced by an invoice, receipt, voucher, or other such document Define the following terms : capital expenditure - this is used to buy capital items, which are assets that will stay in the business for a long period of time. capital items(machinery and vehicles) are fixed assets and intangible assets. & revenue expenditure - is the spending of items on a day to day or regular basis. these are the expenses incurred by a business that are shown on the profit and loss account for example